Are Mexico-China Tariffs on the Horizon?

The short answer is yes — it’s possible. Amid the ongoing U.S.-China trade war and what many analysts describe as a large-scale process of economic decoupling, Mexico may soon adopt new tariff measures on imports from China.

Should this scenario materialize, two key motivations are likely to shape Mexico’s decision: first, the government’s intent to shield domestic industries from the pressures of low-cost Chinese imports; and second, a broader geopolitical alignment with the United States in the context of its strategic rivalry with Beijing.

Protecting Domestic Industry

If Washington and Beijing fail to reach a deal to ease or remove tariffs, the consequences could ripple beyond their borders — particularly for Mexico. A loss of access to the U.S. market would likely prompt China to redirect exports to alternative destinations, including Mexico, offering goods at even lower prices to stay competitive.

In such a scenario, the administration of President Claudia Sheinbaum may reconsider adopting stronger defensive measures, such as increased tariffs, to protect the country’s industrial base. Mexican manufacturers have long struggled with the impact of Chinese imports. Sectors such as textiles, footwear, plastics, aluminum, and toys have proven especially vulnerable.

The issue lies not only in the volume of Chinese goods entering Mexico, but also in unfair trade practices — particularly dumping, where products are sold below market value. This is compounded by smuggling in two forms:

“Contrabando bronco” (outright smuggling), which bypasses customs entirely, and

“Contrabando técnico” (technical smuggling), which exploits legal loopholes or systematically undervalues goods.

In 2024 alone, smuggling caused over 6 billion pesos in tax losses, a staggering 257.9% increase compared to 2022. According to the Confederation of Industrial Chambers (Concamin), in 2023:

86% of textile and apparel imports entered under suspected undervaluation, and

40% of imported footwear was priced below the cost of its raw materials.

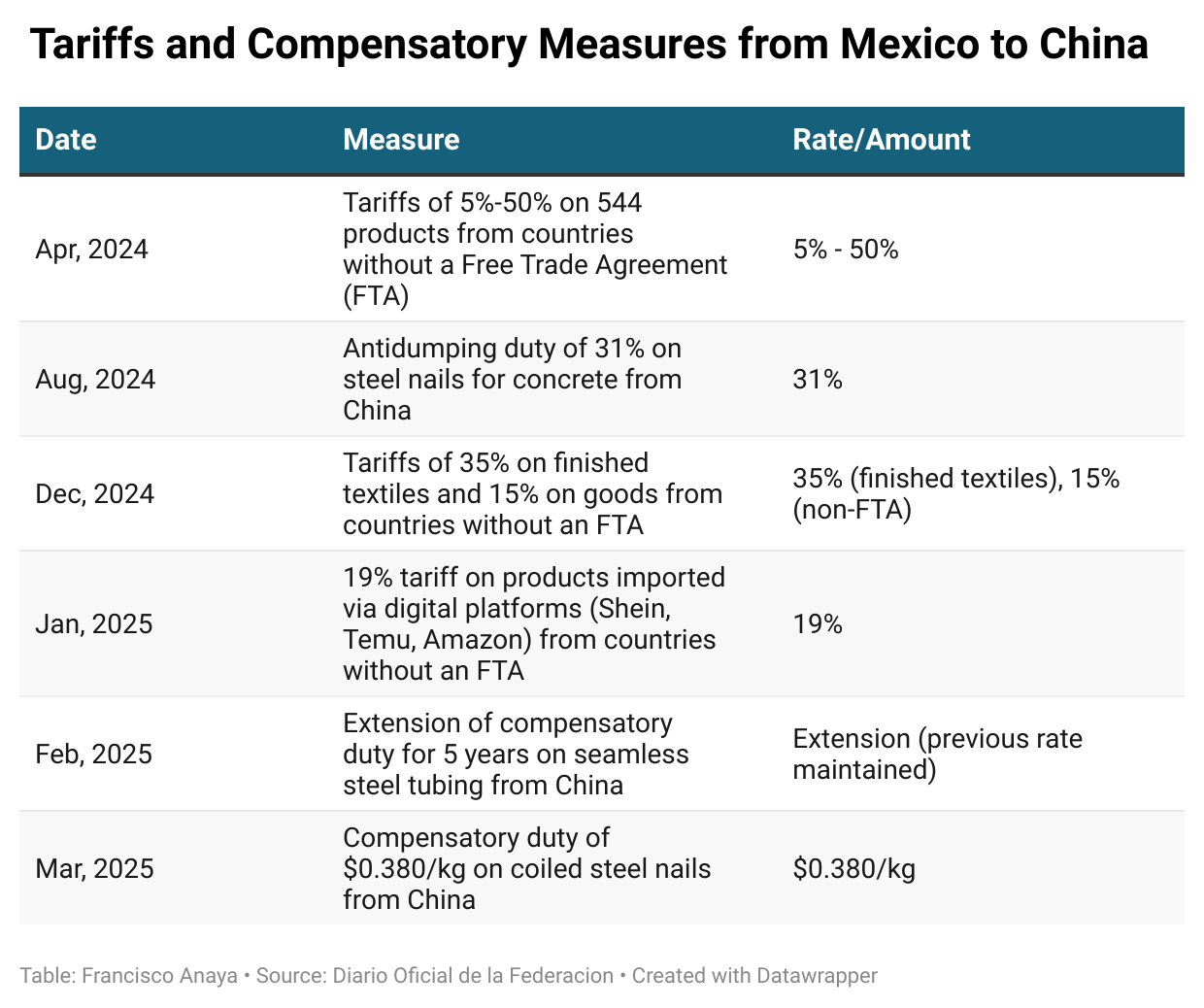

In response, Mexico has already imposed tariffs on imports from countries with which it lacks free trade agreements — including China — and has implemented compensatory duties on certain Chinese products. However, this may only be the beginning of a broader protectionist turn in Mexican trade policy.

“Plan México” and Strategic Import Substitution

These trade measures align closely with Plan México, the ambitious economic initiative unveiled by President Sheinbaum in January 2025. The plan aims to position Mexico among the world’s ten largest economies by 2030 and hinges on an aggressive strategy of import substitution, particularly targeting goods from China.

The goal is to boost domestic manufacturing and create an estimated 1.5 million jobs over five years. In this context, tariff policy becomes a crucial lever for encouraging national production and reducing dependency on foreign inputs.

Still, such measures are not without trade-offs. Restricting imports from China could lead to higher prices for consumer goods and industrial inputs, many of which are vital to hundreds of Mexican businesses. Recognizing these challenges, President Sheinbaum has called on the private sector to diversify supply chains, reduce reliance on Chinese suppliers, and expand trade partnerships within the Americas.

To support this regional reorientation, Sheinbaum has also called for a Summit for the Economic Wellbeing of Latin America and the Caribbean, aimed at fostering deeper regional integration based on shared prosperity and respect for national sovereignty. Whether other governments in the region embrace her vision remains to be seen.

Alignment with the United States

The second major driver of potential Mexican tariffs on China is linked to ongoing trade negotiations with the United States, particularly in the lead-up to the 2026 review of the United States-Mexico-Canada Agreement (USMCA).

Mexico is also lobbying the Trump administration to suspend the 25% tariffs currently levied on its steel and aluminum exports. Earlier this year, in the face of U.S. threats to expand tariffs to all Mexican goods, the Sheinbaum administration explored the possibility of counterbalancing with tariffs on Chinese imports — a policy option that remains under serious consideration.

Historically, Mexico has walked a delicate tightrope, balancing its strategic alliance with the U.S. and its growing economic ties with China. Its approach has largely involved avoiding cooperation with China in areas that could jeopardize U.S. national security interests.

However, as tensions escalate between Washington and Beijing, that balancing act is becoming increasingly difficult to maintain. New areas of economic activity — particularly those involving technology, energy, and supply chain resilience — are now being viewed through the lens of national security. Mexico may soon face growing pressure to take a clearer stance.

In the context of global economic fragmentation, Mexico’s alignment will be crucial to safeguarding its long-term strategic interests.

Toward a More Integrated North America?

Whatever direction Mexico ultimately takes, its fundamental priority is likely to remain unchanged: preserve and, where possible, deepen its strategic partnership with the United States and Canada under the USMCA.

At the same time, the current geopolitical climate may offer an opportunity for deeper North American economic integration. However, that topic deserves a separate discussion — and will be explored in a future article.